Introduction: The Visibility Paradox Every Executive Faces

The boardroom has always been an exclusive space. But today, getting a seat at that table is less about who you know and more about who knows you. Imagine walking into a high stakes networking event wearing a mask. You are in the room, but nobody knows it is you. That is exactly what happens online when a leader lacks a presence. If you are a CEO or founder pursuing board positions, your personal brand is not a vanity project. It is your most strategic asset.

Without deliberate visibility and positioning, you are simply invisible to the nominating committees, search firms, and fellow board members who fill approximately 6,000 board seats that turn over annually in public companies alone.

The data tells a stark story. Executives with strong personal brands are three times more likely to land board roles than those who do not actively manage their reputation. Yet most senior leaders invest minimal effort into their brand until they desperately need it. By then, they are already years behind competitors who have been building credibility, thought leadership, and strategic visibility.

For executives serious about board service, engaging a Personal Branding Consultant has become an invaluable step. Agencies like Ohh My Brand act as partners in accelerating this positioning through CEO branding, LinkedIn strategy, reputation management, and media visibility.

This guide will show you exactly how to build a personal brand that opens boardroom doors with actionable strategies, real world examples, and a practical roadmap from invisible executive to sought after board candidate.

What Personal Branding for Board Positions Means for CEOs & Founders and Why It Matters Now

Personal branding for board service is fundamentally different from corporate marketing or general executive visibility. It is the strategic process of positioning yourself as a governance ready leader with demonstrable expertise in strategic oversight, risk management, and fiduciary responsibility. Your personal brand answers a critical question that every nominating committee asks: “Why should we trust this person to guide our most important decisions?”

The board appointment landscape has transformed dramatically. Gone are the days when board seats were filled through closed door conversations and legacy relationships. Today’s governance environment demands transparency, diversity of thought, and proven expertise across emerging risks from cybersecurity to ESG to digital transformation.

This evolution means that traditional executive credentials alone will not differentiate you. Most board searches now start with digital due diligence which includes Google searches, LinkedIn reviews, and content analysis. If your online presence does not immediately communicate board readiness through effective Content & Storytelling, you are eliminated before conversations even begin.

For CEOs and founders specifically, board positioning matters for five critical reasons. First, board service provides strategic influence beyond your own company, allowing you to shape entire industries while expanding your network exponentially. Second, board roles create attractive exit or transition opportunities, offering meaningful leadership engagement post CEO tenure.

Third, board experience enhances your own leadership by exposing you to diverse business models, governance frameworks, and strategic challenges. Fourth, board appointments generate significant reputational capital that elevates your CEO positioning and opens doors to advisory roles, speaking opportunities, and investor relationships. Finally, board service often comes with substantial compensation while requiring far less time commitment than executive roles.

The urgency around personal branding has intensified because the competitive landscape for board seats has never been more crowded. As companies prioritize board diversity and fresh perspectives, they are looking beyond the traditional pool of retired CEOs and industry veterans. This creates both opportunity and competition. The executives who secure appointments are those who have proactively positioned themselves as visible thought leaders with clear expertise in governance relevant domains.

Consider the transformation required. Your personal brand must shift from operational excellence to strategic governance. Where an executive résumé highlights what you have implemented, a board ready brand showcases how you have guided others to implement. This is not semantic. It reflects a fundamental shift in how you are perceived. Boards seek advisors and overseers who bring wisdom, strategic perspective, and the ability to ask penetrating questions rather than provide operational answers.

The stakes are high. When boards conduct director searches, they are investing trust in individuals who will shape company strategy, oversee massive capital allocation, hire and fire CEOs, and bear fiduciary responsibility to shareholders. Your personal brand must demonstrate that you are worthy of that trust and that starts with intentional, strategic positioning long before you need it.

Common Mistakes Executives Make When Building Personal Brands for Board Service

Even experienced CEOs make critical errors when pursuing board positions. Understanding these pitfalls helps you avoid months or years of wasted effort.

Mistake 1: Starting Too Late

The first and most damaging mistake is waiting until you want a board seat to start building your brand. Personal branding is a long game. Executives who start positioning themselves only when they are ready to transition discover that they are competing against candidates who have been visible thought leaders for years. Board appointments typically result from years of relationship building, consistent visibility, and demonstrated expertise not last minute networking pushes.

Mistake 2: Using a Résumé as a Bio

The second mistake is treating your executive résumé as a board bio. Your corporate achievements matter, but they do not translate directly to board readiness. An executive résumé filled with “executed,” “delivered,” and “implemented” signals operational prowess, not governance wisdom. Boards need to see evidence of strategic thinking, coaching ability, and governance experience. When executives submit executive résumés to board opportunities, nominating committees often do not respond not because the candidate lacks qualification, but because they haven’t communicated the right qualifications.

Mistake 3: Confusing Visibility with Credibility

Third, many executives confuse visibility with credibility. Being active on social media does not automatically position you for board service if your content focuses on daily operations, company announcements, or generic leadership platitudes. Board relevant thought leadership addresses governance challenges, industry level trends, strategic risks, and frameworks for difficult decisions. Without this focus on personal branding through storytelling, your visibility simply makes you a visible executive, not a visible board candidate.

Mistake 4: Neglecting Digital Presence

Fourth, executives often neglect their digital presence entirely, assuming their track record speaks for itself. When nominating committees or search firms evaluate candidates, they immediately Google you and review your LinkedIn profile. If they find outdated information, minimal online presence, or nothing that demonstrates governance thinking, they move on to candidates who have invested in their digital footprint.

In one study, 62% of board members acknowledged that they evaluate potential C-suite candidates partly based on LinkedIn presence and engagement patterns.6 This highlights the importance of LinkedIn Marketing for executive positioning.

Mistake 5: Ignoring Public Credibility

The fifth mistake is focusing exclusively on personal connections while ignoring public credibility. Networking remains critical as approximately 70% of board roles come from existing networks and referrals. However, even strong personal referrals require validation. When someone recommends you for a board seat, the nominating committee will research you. If your public brand does not support the referral, the opportunity evaporates. Your personal brand should make referrals easier, not replace them.

Mistake 6: Broad Positioning

Sixth, many executives position themselves too broadly, claiming expertise in everything rather than owning specific governance competencies. Boards seek directors with clear, differentiated value.8 Are you the cybersecurity expert? The international expansion strategist? The financial restructuring specialist? The ESG authority? Trying to be everything makes you forgettable. Strategic positioning requires choosing specific expertise areas and consistently demonstrating depth in those domains.

Mistake 7: Misalignment with Company Brand

Seventh, executives often misalign their brand with their company’s brand. As a CEO, you are the face of your organization. If your personal brand contradicts your company’s values or strategic direction, it creates confusion and undermines trust. Successful CEO positioning aligns personal brand with corporate mission while establishing the executive’s individual authority.

Mistake 8: Inconsistent Content

Finally, many leaders underestimate the importance of consistent content creation. Thought leadership is not a one time effort. Boards want evidence of ongoing intellectual contribution to your industry. Sporadic posts, occasional articles, or event based visibility do not build lasting credibility. Executives who secure board appointments typically maintain consistent content rhythms like weekly posts or monthly articles that compound into undeniable authority over time.

Step-by-Step Strategic Approach to Building Your Personal Brand for Board Positions

Building a board ready personal brand requires systematic execution across multiple dimensions. This is not a quick project. It is a multi year strategic initiative that compounds in value.

Step 1: Conduct a Board Brand Audit and Define Your Positioning

Before you build visibility, you need clarity on what you are building toward. Start by conducting a comprehensive audit of your current personal brand. Google yourself and analyze what appears on the first page. Ask yourself: if a nominating committee researched me today, what would they conclude about my board readiness?

Next, identify the specific board expertise you will position around. Review your career for governance relevant experience in areas like strategic planning, financial oversight, risk management, international expansion, digital transformation, cybersecurity, ESG, M&A, or crisis management. Do not try to claim all of these. Choose two to three areas where you have genuine depth and can demonstrate unique insights.

Research the types of boards you are targeting. Public companies, private equity backed firms, startups, and nonprofits all seek different expertise. Understanding your target boards helps you tailor your positioning. This focus ensures your brand building efforts attract the right opportunities rather than scattering energy broadly.

Document your personal brand purpose and positioning statement: a clear articulation of who you are, what governance expertise you bring, and what types of boards benefit from your perspective. This becomes your north star for all content, networking, and visibility efforts. We often use proven frame works to built personal brands to ensure this statement is robust and defensible.

Ohh My Brand specialize in this strategic foundation work, helping executives crystallize their positioning through comprehensive brand audits and competitive analysis.

Step 2: Optimize Your Digital Foundation

Your LinkedIn profile is your 24/7 board application. It must immediately communicate board readiness, not just executive achievement. Think of this as Conversion Rate Optimization for your career; you want every visitor to your profile to see you as a viable candidate.

Rewrite your “About” section from a board perspective. Rather than describing your current role, articulate your leadership philosophy, governance experience, and the value you bring to boards. Include board relevant keywords like strategic oversight, fiduciary responsibility, governance, risk management, and stakeholder engagement.

Transform your experience descriptions to emphasize governance skills. For each role, highlight how you worked with boards, led strategic initiatives, managed enterprise risk, or developed succession plans. Use board language like “advised,” “guided,” “provided oversight,” and “stewarded” rather than “executed” or “managed”.

Step 3: Build Consistent Thought Leadership Content

Visibility without substance is noise. To position for board appointments, you need to demonstrate governance level thinking consistently. This means creating content that addresses board level challenges rather than operational tactics.

Develop content pillars which are three to five core themes you will consistently address. For a CEO positioning for technology boards, pillars might include digital transformation strategy, cybersecurity governance, and scaling innovation. Using Bestselling frameworks for personal brands, you can structure these pillars to tell a cohesive story.

Maintain a consistent content rhythm. At minimum, publish weekly LinkedIn posts and monthly long form articles. The most successful board candidates also speak at industry conferences, contribute to business publications, and participate in podcasts or webinars.

Your content should balance several types. Share strategic insights about industry trends and their governance implications. Offer frameworks or models for thinking about board level decisions. Many executives find that Book frameworks for linkedin brand building provide excellent structures for these posts. It is often said that authors make better personal brand strategists because they understand how to craft a narrative arc that keeps an audience engaged over time.

Agencies can dramatically accelerate content output through professional ghostwriting services while maintaining authentic voice and perspective. Some executives even utilize Ebook Writing Services to compile their thoughts into a substantial asset that establishes immediate authority.

Step 4: Engage in Strategic Networking and Relationship Building

Content creates discoverability, but relationships create opportunities. Most board appointments still come through personal networks, so strategic relationship building is essential.

Focus on connecting with three key groups. First, existing board members, especially those serving on boards you would like to join. Second, board search consultants and recruiters who specialize in your industry or expertise area. Third, CEOs and chairs of companies in your target sectors, as they often lead board recruitment.

Join board focused organizations and director institutes. These groups provide structured networking with fellow board members and educational programs that demonstrate commitment to governance excellence. Active participation raises your profile within the board community.

Step 5: Pursue Board Training and Early Board Experience

Credibility comes from demonstrated experience. If you haven’t yet served on boards, pursuing board education and early board opportunities becomes critical. The pathway typically progresses from nonprofit or advisory boards to private company boards to public company boards.

Invest in board governance training and certification. Programs demonstrate commitment to governance excellence. Include these credentials on your LinkedIn profile and in conversations with search firms.

Actively pursue nonprofit board service in organizations aligned with your expertise and values. While unpaid, these roles provide legitimate governance experience: working with a full board, participating in committees, reviewing financials, assessing risk, and holding management accountable.

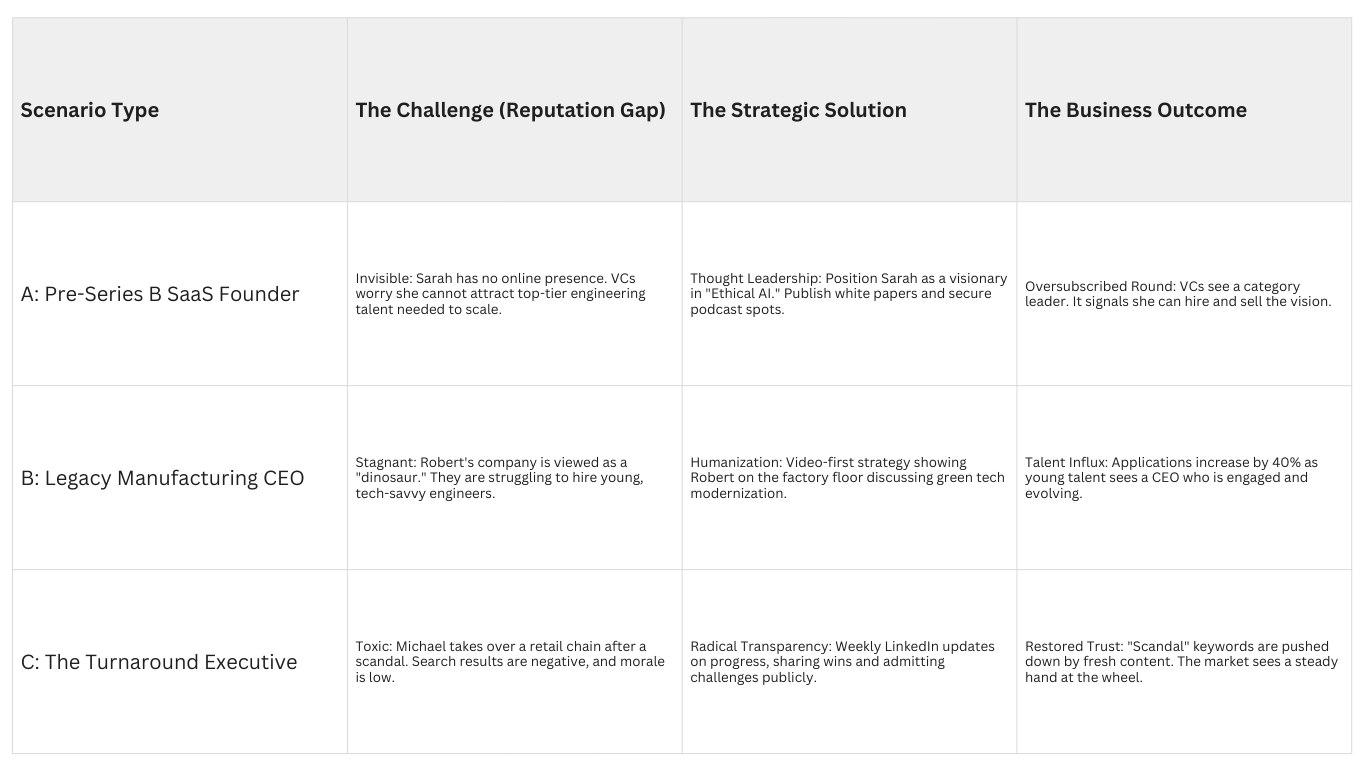

Real-World CEO and Founder Board Positioning Scenarios

Understanding how different executives navigate board positioning helps clarify the strategic choices involved.

Scenario 1: The SaaS Founder Transitioning from Operator to Governor

Jennifer led a B2B SaaS company from founding through a successful exit to private equity.11 Her goal was to serve on two to three technology company boards. Her positioning challenge was that she was known as a strong operator but had zero board experience.

Jennifer’s strategic approach focused on rapid visibility building and leveraging her specific expertise. She identified her governance positioning: scaling SaaS companies through the $10M to $100M revenue stage. She completely rebuilt her LinkedIn profile around this expertise and began publishing weekly insights. Within three months, her LinkedIn following tripled. She utilized a Content system from book based strategies to ensure her posts told a sequential story of growth and governance.

Scenario 2: The Manufacturing CEO Building for Future Board Portfolio

David is the sitting CEO of a mid sized manufacturing company. He is thinking strategically about his post CEO career and wants to build toward a board portfolio.

David took a long view approach, committing to five years of brand development. He began by identifying his unique board positioning: helping traditional manufacturing companies navigate Industry 4.0. He engaged Ohh My Brand to help develop and execute his content strategy professionally. This allowed consistent output without consuming hours David didn’t have. David’s patient approach is paying dividends. After three years of consistent visibility, he received his first board inquiry.

Scenario 3: The Fintech CFO Positioning for Audit Committee Seats

Maria spent 12 years as CFO of fintech companies. She decided to pursue board service specifically targeting audit committee positions.

Maria’s strategy centered on becoming the recognized voice on fintech regulatory compliance. She began writing detailed analysis pieces about regulatory developments. She also pursued speaking opportunities at governance conferences. Critically, Maria joined the board of a community bank, specifically requesting the audit committee seat. This gave her direct audit committee experience she could reference.

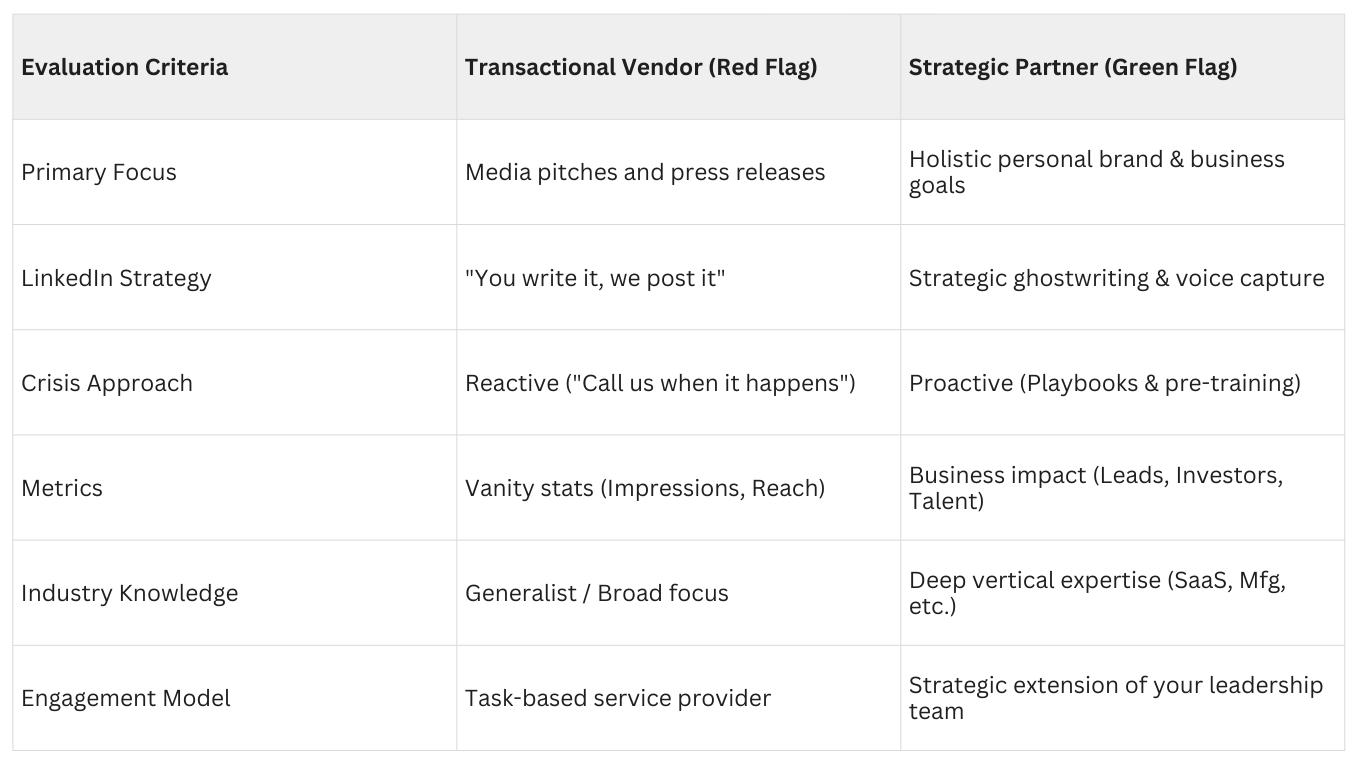

How Personal Branding Agencies Like Ohh My Brand Support Board Positioning

Many executives pursuing board positions work with personal branding agencies to accelerate their positioning and ensure professional execution.

Leading personal branding agencies like Ohh My Brand offer comprehensive services specifically designed for executive positioning. These typically include brand strategy and positioning development, where agencies help executives crystallize their unique value proposition.

Content creation and ghostwriting represent core services that many executives find invaluable. Ohh My Brand provides professional ghostwriters who extract insights from executives through interviews and transform those conversations into polished LinkedIn posts, articles, and thought leadership pieces.

Media relations and executive PR services help executives secure placements in business publications, arrange podcast interviews, and position for speaking opportunities. Agencies also employ an SEO Consultant approach to reputation management, ensuring that executive content ranks well in search results. This often involves Backlink Building strategies to increase the domain authority of the executive’s personal website or profile pages.

Agencies become particularly valuable when executives lack time to personally manage brand building while running companies. The investment varies significantly, but many executives view this as career infrastructure investment that generates returns through board appointments, speaking fees, advisory roles, and expanded business opportunities.

Board Positioning Implementation Checklist for Executives

Translating strategy into action requires systematic execution. Use this comprehensive checklist to guide your board positioning efforts over 12 to 24 months.

Foundation Phase (Months 1-3)

- Complete personal brand audit: Google yourself, review LinkedIn, assess current digital presence

- Identify and document specific board expertise areas (2 to 3 focus areas)

- Research target board types: industries, company stages, and geographies

- Draft board positioning statement articulating your unique governance value

- Update LinkedIn headline, summary, and experience descriptions with board focus

- Optimize LinkedIn profile with board relevant keywords and governance language

- Create featured content section on LinkedIn showcasing any existing thought leadership

- Establish content pillars: 3 to 5 themes you will consistently address

Visibility Building Phase (Months 3-12)

- Publish weekly LinkedIn posts on governance and industry topics

- Write and publish monthly long form articles on platforms like LinkedIn or Medium

- Comment thoughtfully on other executives’ and board members’ content weekly

- Develop relationships with 3 to 5 business journalists covering your industry

- Apply to speak at 2 to 3 relevant industry conferences or governance forums

- Join professional board organizations

- Pursue board governance certification or training programs

- Identify and apply to 2 to 3 nonprofit or advisory boards for initial board experience

- Consider engaging personal branding agency like Ohh My Brand for professional support

Credibility Phase (Months 12-24)

- Maintain consistent content publication rhythm established in previous phase

- Secure 2 to 3 speaking engagements at industry events or conferences

- Publish guest articles in recognized business publications

- Participate in 2 to 3 podcast interviews on governance or industry topics

- Build LinkedIn following to 5,000+ connections with relevant professionals

- Generate measurable engagement on thought leadership content

- Join at least one nonprofit or advisory board if not already serving

- Write about your board experience and governance insights

Frequently Asked Questions About Building Personal Brands for Board Positions

Q: How long does it take to build a personal brand strong enough to attract board opportunities?

Building board ready visibility typically requires 18 to 24 months of consistent effort if you are starting from minimal public presence. However, executives with existing visibility and networks can accelerate this to 12 months with focused positioning and intensive content development. The key variable is consistency. Executives who publish weekly content, speak quarterly, and network strategically can see inbound board inquiries within the first year.

Q: Do I need to hire a personal branding agency or can I build my board brand independently?

Many executives successfully build board brands independently, particularly those comfortable with content creation and social media. However, agencies like Ohh My Brand accelerate the process significantly by providing professional writing, strategic guidance, and comprehensive execution across multiple channels. Consider an agency if you are time constrained, uncomfortable with content creation, want faster results, or need professional quality output.

Q: What’s more important for board positioning: content creation or networking?

Both are essential and work synergistically. Content creates discoverability and demonstrates thought leadership, making you referable and providing validation when someone recommends you. Networking creates direct pathways to board opportunities, as approximately 70% of board appointments come through personal referrals. The most successful board candidates maintain both consistent content that showcases governance expertise and strategic relationship building.

Q: Should I focus on paid or unpaid board experience first?

Most executives begin with unpaid nonprofit or advisory board service to gain legitimate governance experience before pursuing paid corporate boards. This progression serves multiple purposes: it provides board experience you can reference, demonstrates commitment to governance, expands your network with fellow board members, and allows you to develop governance perspectives worth sharing in content.

Q: What role does LinkedIn play in board positioning compared to other platforms?

LinkedIn is the dominant platform for board positioning because it is where board members, search consultants, and nominating committees actively research candidates.13 Your LinkedIn profile functions as your 24/7 board application. Research shows 62% of board members evaluate potential candidates based on LinkedIn presence, making it non negotiable for serious board candidates.

Q: How specific should my board positioning be? Should I position for specific industries or company stages?

Specificity increases effectiveness. Rather than positioning as a general “experienced executive,” identify specific board value such as fintech audit committee expertise, manufacturing digital transformation, healthcare scaling strategy, or cybersecurity governance. Focused positioning makes you memorable and referable. People need to immediately understand what makes you valuable to specific board types.

Moving Forward: Transform Your Board Aspirations Into Appointments

Board service represents one of the most prestigious and impactful chapters in an executive career. But unlike promotions earned through internal performance, board appointments come to those who have deliberately built visibility, credibility, and strategic relationships long before opportunities arise. The executives who secure board seats are not necessarily the most qualified. They are the most visible and well positioned among the qualified.

Your personal brand is the bridge between where you are and the boardroom seats you want. Without intentional brand building, you remain invisible to the nominating committees, search firms, and fellow board members who control access to those opportunities. With strategic positioning, consistent thought leadership, and persistent relationship development, you transform from anonymous executive into sought after board candidate.

The strategies outlined in this guide from foundational positioning through content development to strategic networking provide a comprehensive roadmap. But understanding the strategy and executing consistently are different challenges. Most executives begin with enthusiasm but lose momentum when competing priorities emerge. This is where working with specialists makes the difference between intentions and results.

Ohh My Brand has built its reputation specifically on helping CEOs, founders, and C-suite executives elevate their personal brands to achieve career goals including board appointments. By combining strategic positioning, professional content creation, LinkedIn optimization, media placements, and reputation management, the agency provides comprehensive support that accelerates brand building while respecting the time constraints executives face.

The question is not whether to build your personal brand for board service. The data makes clear that visibility multiplies your likelihood of appointments. The question is whether you will build strategically or haphazardly, immediately or eventually, with professional support or purely independently. Board opportunities emerge unpredictably. The executives who capture them are those who have already positioned themselves as obvious choices. Ready to elevate your executive presence? Connect with Bhavik Sarkhedi to explore a structured, results-driven approach to executive personal branding.